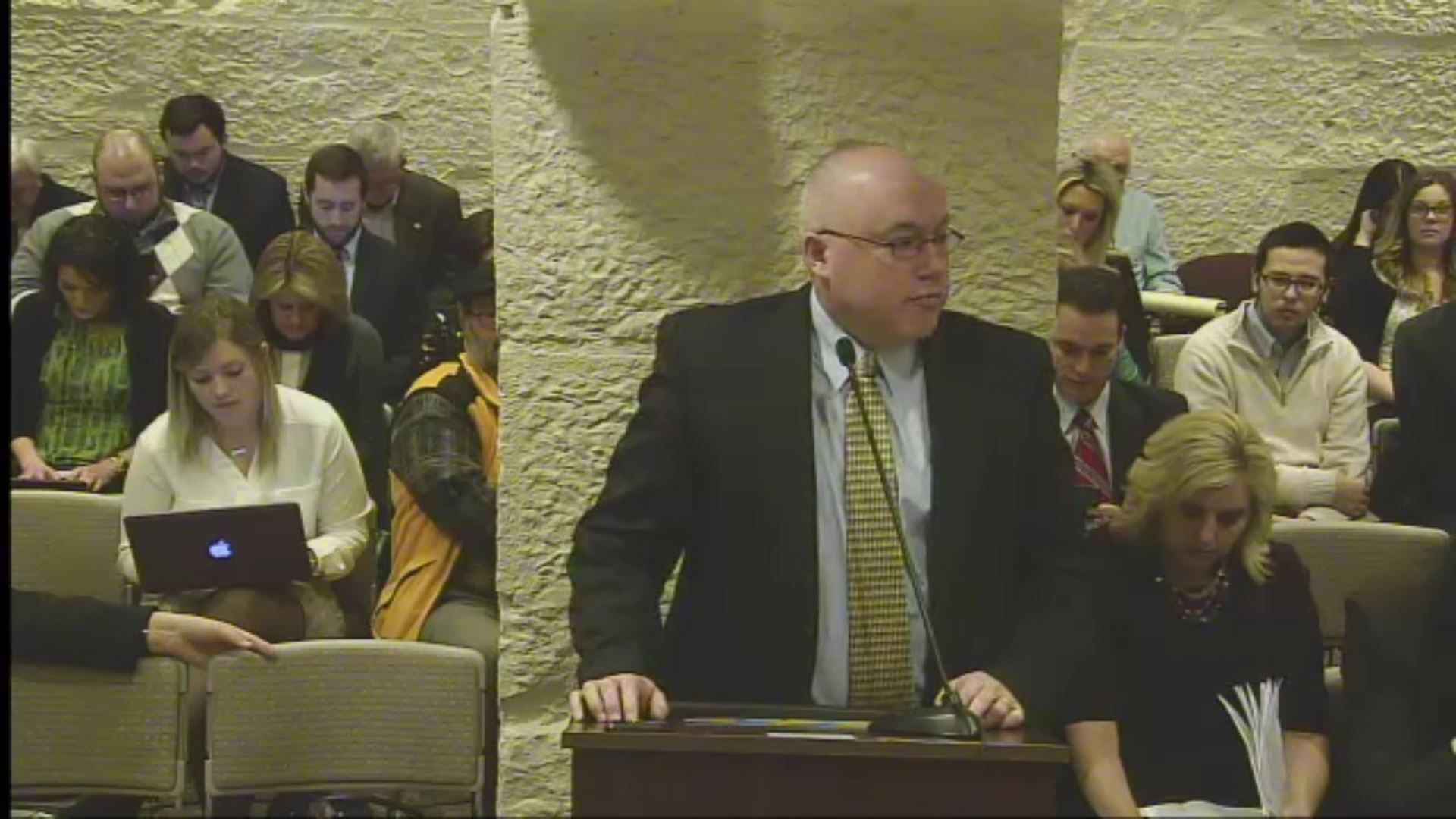

As we outlined in our introduction to this year’s session of the Indiana General Assembly, fighting back efforts to expand predatory lending in our state was identified as a top state policy priority for this year. Accordingly, Prosperity Indiana has been hard at work with other non-profit advocates to stop SB 245 from advancing in the Senate. Today, we are excited to announce that we were successful in killing off the bill, thanks in part to your engagement, responses to our action alert and Prosperity Indiana member testimony.  Steve Hoffman, the President of the Prosperity Indiana Board and the President/CEO of Brightpoint, based in Fort Wayne, provided testimony opposed to the measure and shared client insights and details of the Community Loan Center his organization administers to reduce reliance on payday lending.

Steve Hoffman, the President of the Prosperity Indiana Board and the President/CEO of Brightpoint, based in Fort Wayne, provided testimony opposed to the measure and shared client insights and details of the Community Loan Center his organization administers to reduce reliance on payday lending.

The bill was under consideration in the Senate Insurance and Financial Institutions committee and after testimony from advocacy organizations, members of the faith-based community, veterans, former payday borrowers, and a former payday lending employee, the bill ultimately died with a bipartisan vote of 4-5.

That vote was particularly critical considering an amendment was offered at the last minute that was billed as a less harmful version of the bill, but it still would have allowed a loan amount to $1750 for up to 18 months at an interest rate to 18% per month on the principal balance, which would work out to 216% APR, a harmful product for vulnerable consumers.

would have allowed a loan amount to $1750 for up to 18 months at an interest rate to 18% per month on the principal balance, which would work out to 216% APR, a harmful product for vulnerable consumers.

Below is the testimony provided by Kathleen Lara, Prosperity Indiana's Policy Director.

TESTIMONY REGARDING SB 245

KATHLEEN LARA, POLICY DIRECTOR

FEBRUARY 16, 2017

Thank you Chairman Holdman and Members of the Committee,

My name is Kathleen Lara and I am the Policy Director for Prosperity Indiana an organization that represents 230 non-profits, units of local government, private companies statewide dedicated to building stronger communities.

I wanted to start by taking a moment to express that we also appreciate that bill supporters tried to make improvements to the loan terms compared to the original bill and also that we respect the committee’s interest in trying to find ways to meet the needs of unbanked or under banked individuals and families, but we still feel SB 245 is the wrong approach.

You have already heard exactly how high-cost loans trap vulnerable consumers in debt cycles, but haven’t heard is how this more broadly affects community stability.

Our members are based in Hoosier cities and towns of all sizes focused exclusively on long-term community prosperity, helping low-income individuals and families attain economic sufficiency, break cycles of poverty, and address blight and foreclosures.

They are also organizations left to try and help consumers repair the financial damage left behind when they were inevitably unable to pay back these loans at exorbitant rates.

Our members watch payday lenders that are almost exclusively concentrated in low-income communities market their products as easy financial solutions and know that consumers seeking a last-resort hand up are instead likely to end in default or bankruptcy.

Our members watch these products drain $70 million in fees from the low-income communities they seek to support.

They know that the inability for households stuck in high-interest loan debt to pay expenses like rent, transportation, health care, and food directly correlates to the housing instability and foreclosures, bankruptcies, loss of local spending and accordingly, loss of local job creation they work hard to combat.

An expansion of high-cost lending without regard for a consumer’s reasonable ability to repay is not a true alternative; rather it is another dead end. Even under the amended bill, someone making $12k per year can qualify for $1000 end up paying pay close to $2500 in interest.

We are grateful for the conversation regarding the financial needs of low-income consumers, but we believe the utility assistance, home repair loans, financial literacy education and payday loan alternatives, such the Community Loan Center program Steve referenced, that are offered by our members are the kinds of programs that truly deserve investment and support.

We urge the committee members to instead focus on these solutions. Thank you for your time today.