The 2023 session of the Indiana General Assembly resulted in achieving several priorities from Prosperity Indiana’s policy agenda, including a pair of long-term asset-building goals. But while it had been dubbed the "housing session" in advance by legislators, and even as millions of dollars for housing and economic development were included in the final budget, it will take ongoing effort by Indiana’s community economic development sector to ensure those resources are targeted to the communities with the greatest needs. And despite hundreds of Hoosier tenants, housing providers, and community partners urging legislation to strengthen the state’s woeful habitability standards, they made only the most incremental of progress that will need to be built upon.

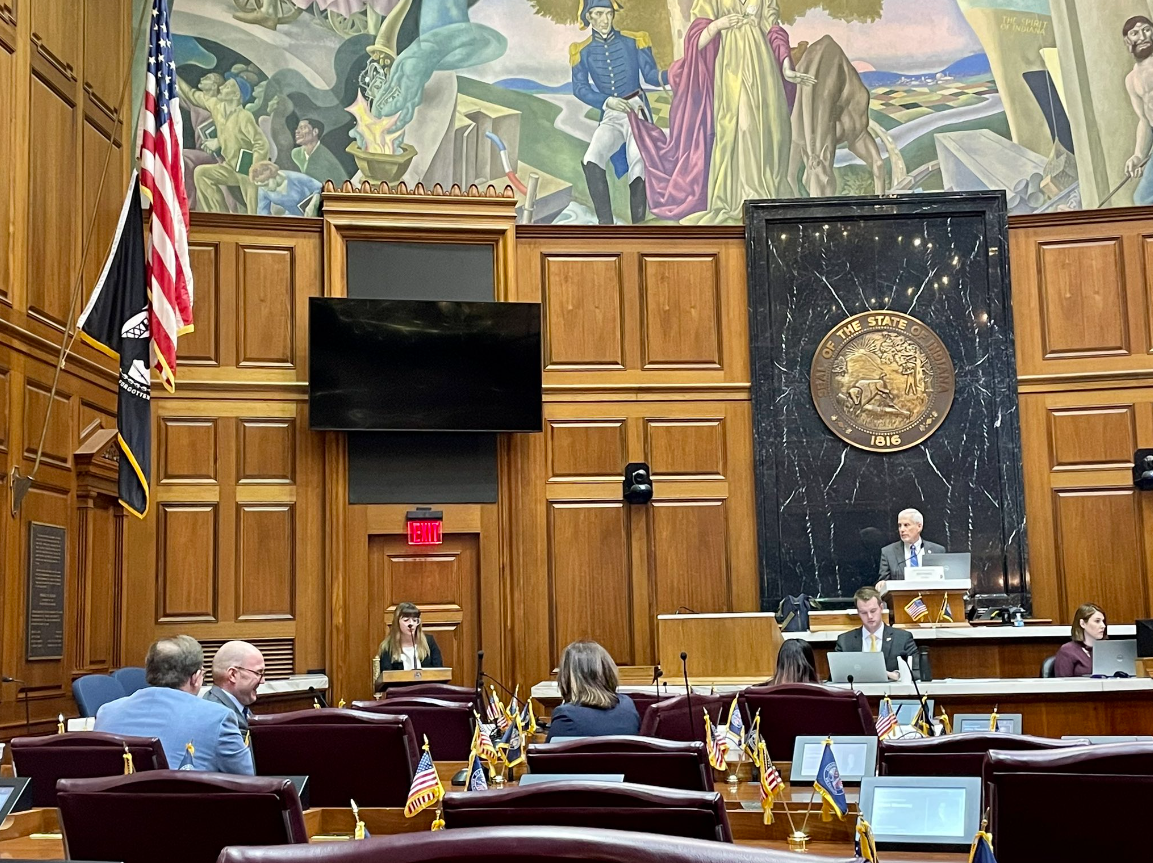

Throughout the session, PI staff and members advocated for the affordable housing, community development resources, and asset building and consumer protection priorities on our 2023 policy agenda ‘Increasing Housing Affordability and Financial Resiliency for Stronger Hoosier Families and Communities’. A post-pandemic record number of supporters attended the PI Statehouse Day on February 2 following our Advocacy 101, 102, and 103 series, and many more Hoosier Housing Needs Coalition partners came out for the second annual Housing Advocacy Day later that month. In addition, PI members and coalition partners sent over 1,000 messages to elected officials throughout the session, urging them to advance our agenda items. Their support made all the difference to pass critical improvements, stop damaging legislation, and raise the profile of key community economic development priorities. Here are outcomes of the bills we followed closely this session whose implementation will most impact the community economic development sector.

Affordable Housing

Even before it started, some legislators dubbed 2023 as the “housing session” due to expected momentum for affordable housing legislation from last fall’s Housing Task Force. PI was represented on that Task Force through the Hoosier Housing Needs Coalition and contributed data describing the statewide housing affordability and stability crisis. The Task Force’s final report included recommendations to increase affordable housing through infrastructure, tax credits, and “addressing substandard housing”, among others.

The most high-profile outcome of the Task Force, HEA 1005 creates a Housing Infrastructure Assistance program and revolving fund, with $75M over two years included in the state budget. Political subdivisions will be able to apply to the revolving fund using criteria that includes investing in a housing study, and through demonstrated need for housing inventory as indicated by the Indiana state housing dashboard. And while PI members testified requesting an additional priority be given to proposals that would develop units affordable to low-income Hoosiers, the authors declined, indicating that the existing criteria could accomplish that end. This means PI members will need to actively engage with their localities to include local examples and data in housing studies so proposals are targeted to develop housing for the communities with the greatest need.

This session, PI and our Hoosier Housing Needs Coalition partners called upon the legislature to increase the supply, access, and habitability of affordable housing statewide. In a positive step, the General Assembly passed SEA 114, which will enable courts to appoint a receiver upon the request of a utility if the owner of a multifamily residential property is severely delinquent on utility bills. While this legislation is good news for tenants whose utilities have been shut off in this case, it will not remedy the fact that Indiana is only 1 of 6 states without laws to enforce health and safety housing standards. In a major missed opportunity, SB 202/HB 1148 would have increased those habitability standards, and would have strengthened enforcement of unresponsive out-of-state corporate landlords, but neither bill was allowed a hearing in their original form. And while SB 202 was transformed into a study committee bill and passed the Senate by a wide bipartisan margin, it was not taken up by the House. The issue is now eligible to be chosen for interim study by the Legislative Council.

In a late-night surprise during the House Rules Committee hearing for HEA 1454 near midnight of the final night of the session, a provision (on pp. 190-191) was revealed that preempts local governmental units from inspecting, or imposing a fee pertaining to the inspection of, a rental unit if a HUD random sample of the rental unit community has been inspected in as much as the previous 36 months. This language had not previously passed either chamber and had not been subject to public testimony or review.

Another missed opportunity: despite PI testimony and hundreds of calls from members, the legislature failed to include funding for a Housing Stability Pilot in the biennial budget. This means state, local, and public-private partnerships will need to find alternative resources to bridge the gap between expiring emergency rental assistance funding and a potential sustainable solution through the federal Eviction Crisis Act sponsored by Senator Todd Young.

Community Development Resources

While the General Assembly did not advance the PI-supported HB 1147 to grow and provide funding options for Indiana’s land banks, the legislature did pass HEA 1627 ‘Sale of tax sale properties to nonprofits’. The bill, which PI members and staff testified to support, extends the ability for the sale of real property to eligible nonprofit entities for low or moderate income housing to all 92 counties.

By far, the legislation providing the greatest potential resources for community development is HEA 1001, the biennial budget bill. However, PI members will need to involve themselves with the implementation of some of these resources to get the most from how the legislative majorities’ prioritized the budget. Several budget provisions with the most potential impact for the sector include:

-

$250M each year for the newly-established regional economic acceleration and development initiative 2.0 fund (READI 2.0). PI members, note that in the bill, an "eligible regional economic acceleration and development organization" means "a development authority" AND a "qualified nonprofit organization" - a private, nonprofit entity formed as a partnership between local units, private sector businesses, or community or philanthropic organizations to develop and implement a regional economic acceleration and development strategy. Also note the potential to combine the impact of READI 2.0 funds with proposals for the $75M Housing Infrastructure Assistance Revolving Fund authorized in HEA 1005.

-

$1M each year for the Housing First program. This continuity in funding is a win, as Housing First programs have been under attack in many states.

-

$20M for a Low Barrier Homeless Shelter Grant Program in Indianapolis. This item was a last-minute pleasant surprise addition to the budget, as part of a larger Economic Enhancement District provision included for the city. While this is good news for Indy residents bearing the brunt of the state's housing stability crisis, it does not replace the need for a statewide eviction prevention fund.

-

$5M for a Homelessness Prevention Grant, with the explanation that the grant be "used to support programs that seek to prevent homelessness among vulnerable populations, including but not limited to foster youth and expectant mothers". This line item may be meant for the construction of a single facility for each of these populations.

-

$4M annually for a newly-established Attainable Homeownership Tax Credit for a taxpayer who makes a contribution to an affordable housing organization. Eligible organizations, such as Habitat for Humanity, are 501c3 nonprofits that use volunteer labor for the construction or development of affordable housing for individuals between 30%-80%AMI.

-

Establishes the Employer Child Care Expenditure Credits - a state tax credit for a taxpayer that makes certain qualified child care expenditures in providing child care to the taxpayer's employees.

Asset Building & Consumer Protections (thanks to PI Coalition Coordinator Hale Crumley for contributions to this section)

Two of the most exciting victories for Prosperity Indiana this session were the inclusion of Earned Income Tax Credit (EITC) reform in the state budget, and the passage of SEA 35 to include a financial literacy course as a graduation requirement. Both of these wins fulfill long-term priorities of the PI co-chaired Indiana Assets & Opportunities Network (see the Indiana A&O Network press release with member and legislator quotes).

In the asset-building sphere, the EITC is a resource for low and moderate income Hoosiers that encourages work by providing a wage subsidy in the form of a tax credit. Most states, including Indiana, have their own version of an EITC, calculated as a percentage of the federal credit. Under current law, Indiana’s state EITC is 10% of the federal credit as calculated before 2009, meaning the state credit is decoupled from the federal credit. The decoupled state EITC has several repercussions including a ‘marriage penalty’ in which a couple currently receives larger individual credits if they are not married, in contrast to the single credit they receive as a married couple. Decoupling also prevented foster parents from being able to claim foster children on their taxes unless they spent the entire year with them. This session, the Indiana A&O Network advocated to strengthen Indiana’s EITC by increasing the state percentage of the federal credit, as well as recoupling the state credit back to the federal credit. Ultimately, while the budget bill did not include an increased state percentage, this time the Genreral Assembly did listen to PI Action Alerts and can 'Fly the W Flag' after including recoupling the EITC with the federal credit in the final budget bill, providing additional relief to thousands of Hoosier families.

SEA 35 rose to the top of a number of bills introduced to increase financial literacy in Indiana’s K-12 education curriculum. Indiana Code 20-30-5-19 already required that personal financial responsibility be taught sometime between 6th and 12th grade, but in no particular manner. SEA 35 require that all Hoosier students starting with the Class of 2028 must pass a standalone financial literacy course in order to graduate high school. These students will be able to earn credit for their studies of money management, debt management, savings, tax returns, credit scores, simple contracts, and more. PI and the A&O Network will continue to work with policymakers to ensure members and community stakeholders are engaged in the implementation of this new requirement.

In addition, the final budget bill included $609,945 in level funding each year for the Individual Development Accounts (IDA) program, with the note that the Division of Family Resources shall apply all qualifying expenditures for IDA deposits toward Indiana's maintenance of effort under the federal Temporary Assistance for Needy Families (TANF) program.

On the consumer protections front, unfortunately the General Assembly did not advance the PI-supported HB 1026 to cap payday loans at 36% APR. But on the bright side, there was a welcome break from the large-scale defensive efforts necessary in previous sessions to prevent expansion of payday lending. However, PI and our Hoosiers for Responsible Lending coalition partners did successfully engage on two dangerous proposals, including HB 1547, which before being defeated, would have eliminated the state’s current ‘step rate’ on large loans and increased the allowable interest rate plus fees. Also, a late addition to SEA 452 would have allowed banks and credit unions to “change, amend, alter, add, or remove any term in a contract or agreement with a depositor at any time” before the provision was removed in conference committee.

Thanks again to Prosperity Indiana members and coalition partners - with your help, this session we've strengthened Indiana's communities and improved Hoosiers' lives.